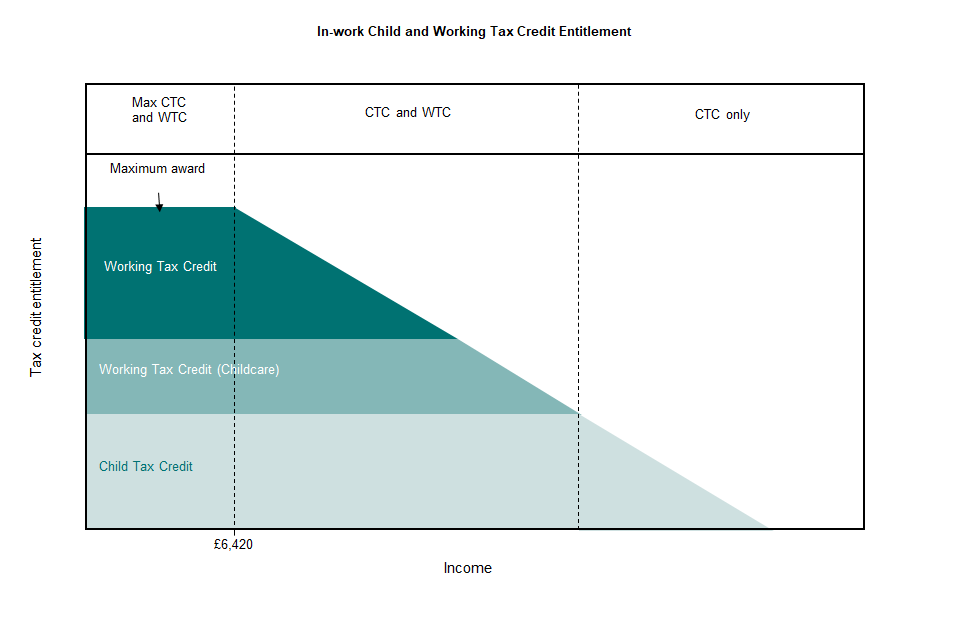

Jobs & Benefits Northern Ireland - You can claim Universal Credit online at www.nidirect.gov.uk/universalcredit. If you currently receive Working Tax Credits, read the information at https://www.gov.uk/working-tax-credit/further-information and use a ...